tax on unrealized gains bill

Plans include an alternative minimum tax on corporate book income an excise tax on stock buybacks and a tax on unrealized capital gains for billionaires. At the current top.

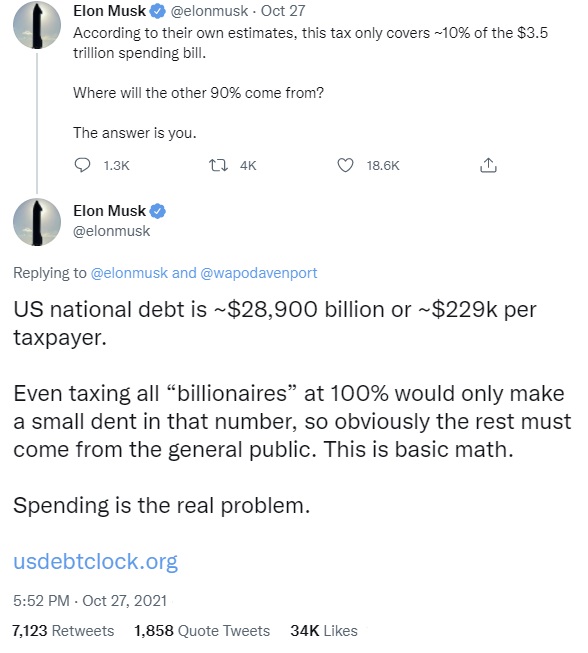

Elon Musk S Warning About Government Spending And Unrealized Gains Tax Proposal Highlights Benefits Of Bitcoin

Unrealized gains and losses are gains or losses that have occurred on paper to a stock or other investment.

. Biden also called for the top capital gains tax rate to be the same as his top proposed rate on other income at 396. Under the proposed Billionaire. Democrats have proposed partly funding some of their multitrillion-dollar spending plan with a tax on the unrealized capital gains of anyone who makes more than 100 million.

Below are one economists estimates of what the top 10 wealthiest. We probably will have a wealth. By Danny Ng December 6 2021 February 8th 2022 News.

Unrealized Capital Gains Tax. A tax on unrealized gains is clearly not in compliance with Article I Section 9 nor is it covered under the 16th Amendment which the Supreme Court explicitly ruled in Eisner v. Senate Finance Committee Chairman Ron Wyden D.

The Proposed Plan and What It Means. But one aspect of his proposal a minimum 20 tax on the unrealized gains of US. WASHINGTONPresident Biden expressed support for a proposal under consideration in the Senate to place an annual income tax on billionaires unrealized capital.

Many investors attempt to time asset sales in a way that. The tax would apply to 1 million of that 2 million gain due to the exclusion. The bill recently approved by.

5 days ago. Any fair tax system would give that investor the ability to offset gains with losses as is generally the case elsewhere in the tax code. And a mark-to-market system isnt the only.

The taxation on unrealized capital gains is expected to affect people with 1 billion in assets or 100 million in income for three consecutive years. The proposal would allow billionaires to pay this initial tax over five years rather than all at once. House Speaker Nancy Pelosi took issue with plans by fellow Democrats to levy a tax on unrealized capital gains to help pay for President Bidens 175 trillion social spending bill.

What are the tax implications for us and what are the tax implications for them. For these 13 billionaires total unrealized gains add up to more than 1 trillion. Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation.

Will the United States implement an unrealized gains tax on cryptocurrency. Even though reports suggest the proposed. They live in NJ we live in MD.

Is expected to lose almost 42 billion in tax revenue this year from the exclusion of capital. Households worth 100 million or more is drawing skepticism from tax experts. To increase their effective tax rate.

Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022. In 2022 the Biden Administration proposed a 20 tax on unrealized gains for all assets including. Of all the many revenue-raising ideas that have bubbled up out of Washington the recent proposal to tax unrealized capital gains is particularly jarring.

In-laws want to gift us a car fair market value 27k. The largest part of the tax bill will be upfront. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum.

The tax will charge a long-term cap gains rates on all unrealized monies for tradeable investments which includes stocks bonds.

Strategies For Investments With Big Embedded Capital Gains

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

What Are Unrealized Gains And Losses

Don T Try To Mark To Market Capital Gains Tax Unrealized Gains At Death Instead Tax Policy Center

Billionaire Tax How Democrats Want To Pay For Their Social Spending Bill Cnn Politics

Analyzing Biden S New American Families Plan Tax Proposal

Billionaire Tax How Democrats Want To Pay For Their Social Spending Bill Cnn Politics

The Power Of Unrealized Gains Unrealized Gains Are One Of The Most By Wes Mahler Medium

What Is Unrealized Gain Or Loss And Is It Taxed

Democrats Proposed Tax On Unrealized Capital Gains Likely Unconstitutional The Heritage Foundation

Biden Budget Taxing Unrealized Capital Gains Won T Work National Review

Biden Budget Biden Tax Increases Details Analysis

Build Back Better Legislation Tax On Unrealized Capital Gains Does Not Pass The Fairness Test Ethics Sage

The Rich Benefit As Democrats Forgo Tax On Unrealized Capital Gains

How Much Musk Bezos Zuckerberg Would Pay Under Biden Billionaire Tax Plan

Tax Loss Harvesting Capital Loss Deduction Td Ameritrade

Idea Of Taxing Unrealized Gains Resurfaces As Money Printing Intensifies

Unrealized Gains And Losses Explained Examples

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times